In this Post:

- When will payments show up on your credit report?

- Paying off debt raises your score

- Try on-time rent payments to raise your score

- Other timely payments that help credit score

- Fixing payment history on your credit report

Have you ever been asked to prove your academic capabilities to a college admission officer? Have you ever needed to prove your worth to a potential employer? Have you ever required proof of eligibility for a loan?

If you have, you’ll know that different situations require different types of proof. Likewise, credibility in the financial arena requires good credit. And that begins with a solid payment history.

Your payment history is the most important information a lender can have about you. It tells lenders how you’ve handled credit in the past — which is usually a good indicator of how you’ll handle credit in the future.

On-time payments is the best thing you can do for your credit score because it shows lenders that you handle credit responsibly.

When will payments show up on your credit report?

The short answer of when you can expect a payment to show up on your credit report is about 30 days. But that is only an average. It can take more time, or it can happen sooner.

Why?

Your credit report reflects information provided by lenders. There is no federal law mandating when or even if lenders report to credit bureaus. It's up to each lender's own discretion.

But as soon as a lender reports information about your account to the credit bureaus, the credit bureaus add that information to your credit report.

Paying off debt raises your score

Expect to wait a few months after paying your debt to see an increase in your credit score. Although lenders credit you immediately after you pay off debt, they need to report your activity to the credit bureaus in order for your score to increase. Since lenders typically wait until the end of the billing cycle to do that, it may take a full month for you to see an increase in credit score .

Then, after your lender reports to the credit bureaus about your debt being paid, the credit bureaus wait about a month to see that you don’t take on more debt or miss payments from other lenders before they update your score.

Try on-time rent payments to raise your score

Paying your rent on time can be an excellent way to raise your credit score. But there’s one catch — not every landlord reports to the credit bureaus. And if your good behavior isn’t reported, your score won’t rise.

Here’s what to do if you’re a renter:

- Ask your landlord or property manager if they report to the credit bureaus.

- If the answer is, “Yes,” you’re set.

- If the answer is, “No,” you can sign up to pay your rent through a service that reports to the credit bureaus, such as RentTrack, eRentPayment, or Rental Kharma.

Tip: When you look into using a service that reports to the credit bureaus, check to see whether the service is free or whether fees are involved. Also check to see which credit bureaus they report to. Some report to all three bureaus and others report only to one or two.

Another option you might have is to pay rent using your credit card. Note that this method won't show up as a rent payment on your credit report, but your score will go up anyway ... that is, if you make your credit card payments on time.

Paying rent by credit card is only an option if your landlord or management company allows this.

Tip: If you use your credit card to pay rent, make sure to pay off the rent portion of your credit card balance every month, just as if you were paying rent to your landlord. Otherwise, you could get way behind, maxing out your credit card in no time.

Other timely payments that help credit score

When you think about making timely payments, if you’re like most people, you automatically think of your credit cards. But there are other timely payments that help boost your credit score.

Here are the account types included in your payment history:

- Credit cards

- Auto loans

- Store credit cards

- Bank loans

- Mortgage loans

Timely payments you make to all the above will positively affect your credit score.

Additionally, setting up your rent, utility and phone bill payments to reflect on your credit, you may be able to pull your score up even higher if making timely payments in these areas.

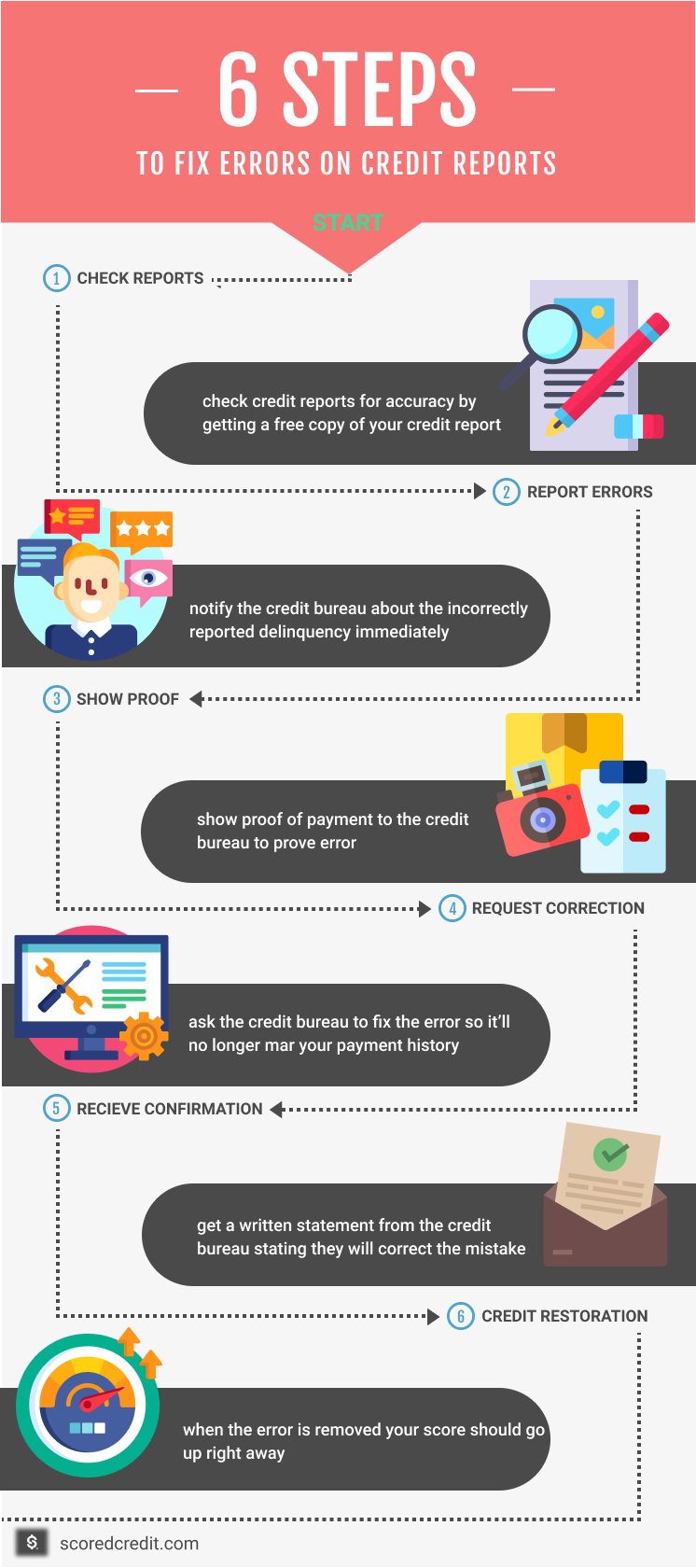

Fixing payment history on your credit report

The first step to take to fix payment history on your credit report is to confirm the accuracy of any missed or late payments. Credit reports often contain errors.

Here’s what to do:

Check all three of your credit reports for accuracy by getting a free copy of your credit report at AnnualCreditReport.com. If one credit bureau shows an error, the others could as well.

Tell the credit bureau immediately — preferably in writing — if there is an incorrectly reported delinquency on your credit report.

Show proof of payment to the credit bureau.

Ask the credit bureau to fix the error.

Make sure you get something in writing from the credit bureau stating they will correct the mistake.

When the error is removed, your score should go up right away.

Credit repair service

If your credit reports are accurate, and you do have some blemishes, you might be tempted to use a credit repair service. However, you can do everything yourself — for free — to improve your credit score, so there’s really no need for a credit repair service.

Here’s what IS recommended

- Pay all your bills — including mortgage, lease and loan payments — on time. The longer your history of on-time payments, the higher your score will go.

- Set up autopay for at least the minimum amount, particularly if you’re not the most organized person regarding paying your bills. Setting up autopay means that you will never be late again.

Tip: You must keep enough money in your bank account to cover the payments each month. And it’s a good idea to check to make sure your payments were sent.

- If you don’t like the idea of autopay, set up reminders on your calendar to pay your bills on or before the due date. Of course, you then will need to actually pay the bills when you see the reminder.

With all that said, there can be some limited circumstances where a credit repair service could help you. Maybe you simply don't have the time to deal with fixing your credit score on your own. Or maybe you just don't feel confident contacting the credit bureaus. In those cases, you might want to use a service. Just never pay upfront. It’s against the law for companies to charge people upfront for credit repair.