In this Post:

- How Bankruptcy Works

- Types Of Bankruptcies

- Chapter 13 Bankruptcy

- Filing For Bankruptcy

- Bankruptcy and Credit Scores

- The Impact of Foreclosure on Credit Report

- It Is Still Possible To Get A Mortgage

- Raising Your Credit Score After Bankruptcy

If you’re even thinking about filing for bankruptcy, you’ve probably got some serious debt concerns. Bankruptcy can be a solution when the bills are mounting and you can’t make the payments, but there’s a hefty price to pay.

Bankruptcy will give you some relief from creditors. However, bankruptcy negatively affects credit in a significant way. It will crush your credit score and severely limit your ability to get credit in the future.

How Bankruptcy Works

In 2018, 756,722 people filed for bankruptcy. Bankruptcy is a way to get out from under crushing debt and get a second chance to start over. If you are in a situation where you can’t pay off debts you owe and don’t see that situation changing anytime soon, bankruptcy may be an option. However, it’s never a step to take lightly.

A judge and a court-appointed trustee will analyze your assets and liabilities and make decisions about what to do. The court will make a binding ruling on what to do with the debts you owe and the things you own. The judge can cancel some debts and they can also force you to sell most of your belongings.

Bankruptcy does not eliminate all of your debts. Alimony payments, child support, student loans, and unpaid taxes will not be discharged.

Types Of Bankruptcies

Individuals can file for either Chapter 7 bankruptcy or Chapter 13 bankruptcy.

Chapter 7 Bankruptcy:

Filing for Chapter 7 bankruptcy is the more common type of bankruptcy, of the two choices. It accounts for 62% of the personal bankruptcies filed. Under Chapter 7, all assets that are considered “non-exempt” are sold off by the trustee. Exemption laws vary by state, but typically you can keep things that will you need to maintain a job and a household. Non-exempt items would include things such as property that’s not your primary residence, a car or truck with equity, investments, artwork, collections, musical instruments, expensive clothing, or jewelry

When non-exempt goods are sold, the money is used to repay creditors. Whether the debt is paid in full or not, once the bankruptcy is completed, the debt is wiped out.

What assets you can keep and what you need to sell is difficult to answer because there are so many variables. Each state sets maximum limits to what they consider reasonable for you to keep. They call these exemptions. If your assets meet these state thresholds, you may be able to keep your assets. For example, if the state has a vehicle exemption of $5,000 and your car is worth $3,000, you’ll likely get to keep it. If your car is worth $20,000, it will likely be sold, and you would get $5,000 from the proceeds. The remaining would be used to pay off the debt.

Some states have homestead exemptions which will allow you to keep your primary residence, subject to limitations and years of residency. These limitations also vary by state, and sometimes by cities within the state. For example, $100,000 worth of your home’s equity would be exempt anywhere in the state of Idaho. In many parts of New York state, the limit is $142,350. It’s higher in New York City itself. If the equity in your home exceeds the amount set by the state or city, you may be forced to sell so that the excess equity can be used to pay off debt.

When there are still outstanding payments on the car or a mortgage on your home, the calculations can get complex since you don’t yet own the asset fully. Lenders can still foreclose on your home if you don’t have enough money to bring your mortgage current and continue to make monthly payments.

Limitations

There are limitations to who can file for bankruptcy. You must pass a “means test.” If your total income is less than your state’s median income, you’ll qualify. If your income exceeds the state’s median income, the court will also look at area guidelines for reasonable monthly expenses to determine whether any of your earnings would be considered disposable income above what you’d need to live on. Disposable income would be applied by the trustee to outstanding debt.

If you deduct these costs and still have money left over, you won’t be able to file for Chapter 7. You may be able to file for Chapter 13, however, as you’ll see below.

Chapter 13 Bankruptcy

Chapter 13 represents the other 38% of bankruptcy filings. In this case, bankruptcy is used to eliminate debts by creating a repayment plan. You make monthly payments to a trustee who distributes money to creditors over a three-to-five year period.

Calculating payments under a Chapter 13 filing is complex. In order to file for Chapter 13, you must have a reliable source of income. From that amount, the court will deduct “reasonable and necessary expenses.” These expenses will by location. It can also be a major point of contention in negotiations as these reasonable expenses don’t include any frills. For example, if you can reasonably rent an apartment in your community for $1,000 a month, any amount above that would be considered unreasonable by the bankruptcy court. If your rent was $1,500 a month, you would be required to move to a less expensive location or pay the difference in order to stay. The idea is that if you can afford to pay the extra $500 a month for rent, then you can afford to pay an extra $500 a month to creditors. If you don't have the money, you may have no choice but to move.

What’s left between your income and expenses is your disposable income. In most cases, that amount goes toward your repayment plan. The trustee and the court will review the plan to use this payment to allocate payments to priority debts, secured debts, and unsecured debts.

Secured debt has property or physical assets that can be seized if you fail to pay your debt. For example, if you buy a car on credit and stop paying the bill, the lender can repossess your car. A mortgage lender could foreclose on your home if you default on payments. These are secured debts.

Unsecured debts don’t have property or assets to act as collateral. These are debts such as credit cards, rent, utility bills, student loans, or medical debt. Unsecured debt is further broken into priority and non-priority debt.

Priority debts get paid first in a bankruptcy. These include items such as alimony, child support, taxes, or penalties you owe to a government entity. Non-priority unsecured debt includes items such as utility bills, credit card bills, medical debt, or health club dues.

Many people facing foreclosure on their homes will choose Chapter 13 to keep their home. Trustees can often work out payment plans to forestall foreclosure.

When you emerge from Chapter 13 bankruptcy, your debt will be discharged. This means all your creditors will have been paid. If you fail to live up to your repayment plan, your Chapter 13 bankruptcy will be dismissed. If this happens, the bankruptcy is deemed void and creditors can sue to foreclose on assets or garnish your wages. When garnishment occurs, a court issues an order that requires your employer to withhold a certain amount of your paycheck and use it to pay your creditors.

If you can manage the court-approved repayment plan, you may be able to keep more of your assets under Chapter 13 than under Chapter 7.

You will still be subject to asset exemptions that differ state-to-state. For example, if your car is worth $20,000 and the state limits the value of vehicles you can keep in bankruptcy to $5,000, you would need to pay your creditors the difference as part of your bankruptcy repayment plan ($15,000) to satisfy the debt. If you didn’t have the $15,000 at the time, you would need to sell the vehicle and put any proceeds above the $5,000 limit towards debt payments.

Chapter 13 will allow you to stop foreclosure on your home, at least temporarily. Filing a petition for relief under Chapter 13 puts a hold on foreclosure proceedings and other debts owed while the court considers the plan. It does not eliminate the debt. You’ll still have to make any new payments that come due while the court decides. If the bankruptcy plan, devised under Chapter 13, frees up enough income to make regular mortgage payments, and repay any missed payments over time, you may be able to keep your home.

Limitations

There are limitations to who can file for Chapter 13. You must have no more than $394,725 in unsecured debt, such as credit card bills or personal loans. You cannot have more than $1,184,200 in secured debt, such as mortgages and car loans. These amounts are adjusted periodically and are tied to the CPI (Consumer Price Index). The CPI is an index published periodically by the U.S. Department of Labor. It tracks the prices of consumer goods and adjusts the index periodically to account for the effects of inflation.

Filing For Bankruptcy

You can file for bankruptcy without an attorney, but the laws can be complex. Most people do hire a bankruptcy specialist to help navigate the system. In addition to filing fees, an attorney can cost between $500 and $6,000, depending on the complexity of your situation, your location, and who you hire.

Before you can file, you’ll need to gather documents, including tax returns for two years, pay stubs for the past six months, bank account statements, retirement accounts, appraisals of real estate you own, car registrations, and other documents to establish your level of income, assets, and debt.

The court will require you to go through mandatory credit counseling before filing. Fees will vary by provider. Counselors will give you a certificate of completion that you’ll need for the filing.

Then you’ll have to fill out the forms. There are 23 separate forms (about 70 pages). You’ll take your filled-out forms and go to court to file. It costs $335 to file for Chapter 7 and $310 for Chapter 13 across the United States. The bankruptcy trustee may charge fees as well.

If you are unable to afford the fees for a Chapter 7 filing, you can apply to have the fees waived or pay in installments. You must do this at the same time you file in federal court. In deciding whether to grant a waiver, the court will look at whether your income is below 150% of the poverty level in your state as determined by the U.S. Department of Health & Human Services.

Bankruptcy and Credit Scores

Bankruptcy affects credit immediately. Your score will likely take a significant hit and your credit report will show a bankruptcy for years to come. Some will see scores drop by more than 200 points when bankruptcy occurs. The exact amount will vary depending on your specific situation.

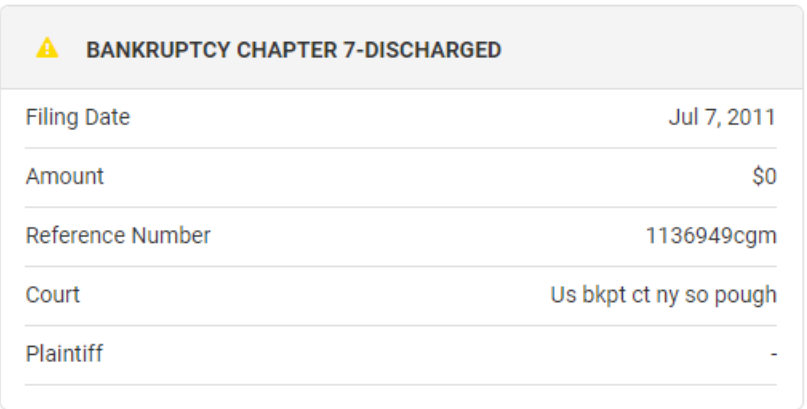

For Chapter 7 bankruptcies, the bankruptcy will show up on your credit report for 10 years, while Chapter 13 bankruptcies stay on your report for 7 years.

Chapter 7 bankruptcy discharge report sent to creditors, showing a zero dollar amount.

There’s no way to remove a bankruptcy from your credit report except to wait until the proper amount of time has passed. It will be removed automatically once that happens if you provide the proper paperwork to the credit reporting agencies showing it’s been discharged.

Chapter 7 will wipe out your debts. You’ll no longer owe the money. However, unpaid bills will still show up on your credit report with a note that they’ve been discharged through bankruptcy.

Under Chapter 13, you are making a promise to repay the debts. They will also show up as past due and still owed on your credit report until you’ve paid them off. Once you have paid them off on your repayment plan, they will be listed as paid with a zero balance.

Typically, under Chapter 13 plans, you are prohibited from taking on any new credit. When your Chapter 13 bankruptcy is discharged, your credit score will still feel the effects for several years.

You may be able to apply for credit before the 7- or 10-year period passes, but most credit card companies will suggest a secured card instead of a credit card. With a secured card, you make a cash security deposit which you then draw against. If lenders will issue credit, they will demand a higher interest rate since you are at a greater risk of default.

The Impact of Foreclosure on Your Credit Report

A foreclosure on your credit report is bad but not as bad as bankruptcy.

Why? Because in a foreclosure, you’re losing your home and any equity you built up. Your credit score will take a serious tumble and you’ll have a tough time getting a mortgage. It’s not considered as bad as bankruptcy, however. In bankruptcy, you are demonstrating the inability to fulfill your debt obligations for your home as well as all of your other debts.

Both will hurt your credit score and ability to get credit in the future. A foreclosure and Chapter 7 bankruptcy will stay on your credit report for 7 years. Chapter 13 will stay on your report for 10 years.

However, a foreclosure has less of an impact than a bankruptcy on your credit score. FICO, which is the largest provider of credit scores, estimates someone with a credit score of 680 that suffers a foreclosure might see a hit to their credit score of 115 points, while a bankruptcy would drop scores by 150. Both would change you credit rating from good to poor. Likewise, someone with a 780 FICO score that goes through a foreclosure might see a drop of 160 points compared to a 240 point drop for bankruptcy. This would change your credit score from being rated as very good to below average for foreclosure or poor for a bankruptcy.

After Declaring Bankruptcy, It Is Still Possible To Get A Mortgage

When your discharge order has been issued by the court, it is possible to credit. Under Chapter 7, this discharge will occur after the court closes your case, litigation ends, and creditors have been paid whatever money is available. This typically happens in 3-5 months.

Most lenders will want to wait at least two years from the date of your Chapter 7 discharge before considering a mortgage. Creditors will want to see that you have bounced back from your credit trouble and have demonstrated financial responsibility after the bankruptcy.

Under Chapter 13, the discharge order doesn’t occur until after the 3- or 5-year repayment plan is complete and debt balances have been paid. You may be able to obtain a mortgage during this repayment period after making 12 months of payments and the court approves your request. You’ll also have to demonstrate that you are not likely to need bankruptcy protection again.

If you fail to complete your repayment plan, you will likely have trouble getting a mortgage for 4 years.

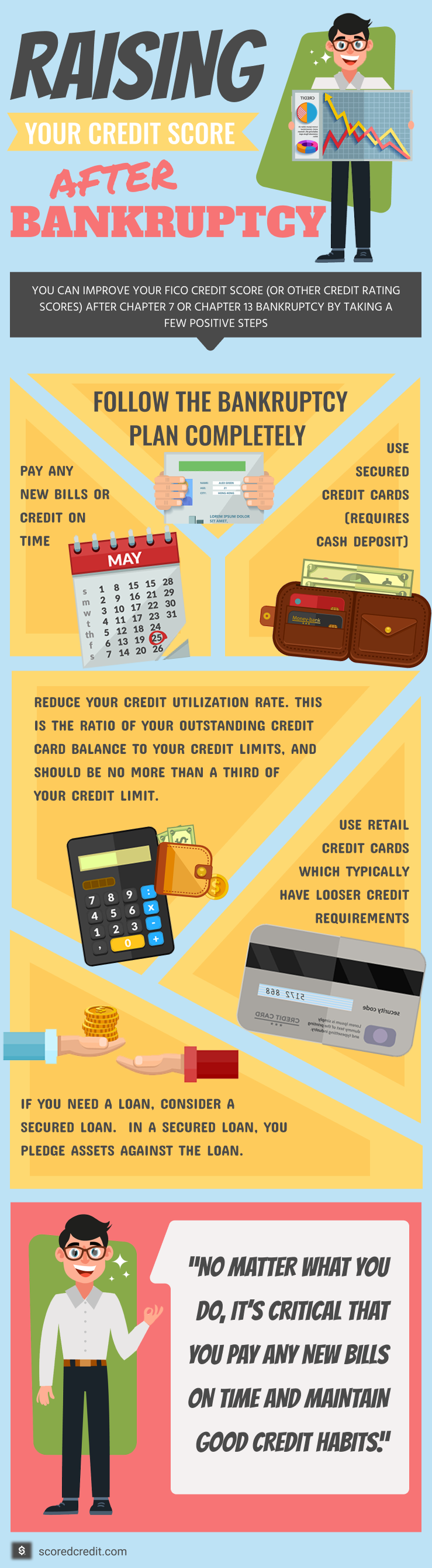

Raising Your Credit Score After Bankruptcy

You can improve your FICO credit score (or other credit rating scores) after either a Chapter 7 or Chapter 13 bankruptcy by taking a few positive steps:

- Follow the bankruptcy plan completely

- Pay any new bills or credit on time

- Reduce your overall credit utilization rate. This is the amount of available credit you have versus what you have used.

- Use secured credit cards (requires cash deposit)

- Use retail credit cards, which typically have looser credit requirements

- If you do need a loan, consider a secured loan. In a secured loan, you pledge assets against the loan.

No matter what you do, it’s critical that you pay any new bills on time and maintain good credit habits.

After your bankruptcy has been completed, you will want to check your credit report carefully to make sure it’s correct. You will want to make sure that accounts that have been discharged are reported as discharged with a zero balance. You’ll also want to make sure the bankruptcy filing date is correct.

As time passes, your credit score will improve if you can demonstrate you are managing your credit responsibly. There’s no way to put an exact timeline or number on it because every situation is different. Once you have a bankruptcy on your record, you will need to prove your worth the risk for future creditors.