In this Post:

- Credit Utilization: An Overview

- Credit Utilization Ratios

- Minimum Credit Utilization

- High Credit Utilization

- Credit Utilization and Your Credit Score

- Calculating Credit Utilization

- How to Lower Credit Card Utilization

- Balances Report

- Debt-To-Income Ratio

- Conclusion

When it comes to building your credit, there’s a secret ingredient that can have a major impact on your credit score. The not-so-secret and obvious ingredient is making your payments on time. There’s something else that has close to the same impact — your credit utilization.

But what does credit utilization actually mean?

We’ll break it down for you and help you learn how to keep your credit in good shape.

What Exactly Is Credit Utilization?

Building credit can seem complicated, but really it can be quite simple if you focus on two things:

- Make your payments on time

- Keep your credit utilization low

But what is credit utilization? And more importantly, how does it impact your credit? Your credit utilization refers to the percentage of credit that you are actually using.

What Is a Credit Utilization Ratio and Why Does It Matter?

Your credit utilization is the amount of credit you use. Let’s say you get a credit card and are approved for a $2,000 credit limit. If you charge $1,500 on your credit card each month, you have a credit utilization rate of 75%.

At this point, that may not mean much to you. I mean, if you make your payments on time, what gives? Who cares, right?

But not so, my friend.

Your credit utilization matters and 75 percent is definitely above the recommended ratio. You might wonder what is a good credit card utilization ratio? A good rule of thumb is 30 percent or less. This isn’t a hard and fast rule though. It’s best to have a low credit utilization, but more than zero so it shows you are charging something and can pay it back. One expert from CreditCards.com recommends having a utilization of 25 percent.

But for sake of example, let’s stick to the 30 percent credit utilization rule. In this case, if you have a $2,000 credit limit, you’d want to have no more than $600 charged on your credit card. If you do have a high credit utilization, but only for a short time, you are not at risk for long-term damage to your credit.

This may seem like a bummer, especially if you’re trying to rack up credit card rewards and use your credit card as part of your everyday budget. But there’s an important reason why credit utilization matters — it’s another way that lenders assess risk.

It’s important to note that credit utilization only refers to credit cards. Mortgages or personal loans won’t improve your credit utilization or be considered. However, we’ve seen that authorized users’ balances can affect your credit score.

What’s the Recommended Minimum Credit Utilization?

If you want to have a low credit utilization you may wonder what’s the minimum credit utilization to build credit. While below 30 percent is advised, you do want to have some balance to pay off in order to build credit. So to get started, perhaps have one bill you charge on the card per month and pay it off in full.

Can a High Credit Utilization Affect My Credit Score?

Is high utilization bad? To a lender, yes, and we’ll tell you why.

In lenders’ eyes, a credit card is essentially like borrowed money. A credit limit of $2,000 is like a short-term loan of $2,000, that you pay back each month. Using all of your available credit each month — despite making on-time payments and positive repayment history — can be a signal that you might be an at-risk consumer.

So the question is, “Can a high credit utilization lower my credit score?” The answer? Absolutely.

Think of it this way, let’s say your friend asks to borrow $2,000 each month from you. They paid you back and yet they keep asking you for the same amount each month. At some point, you might think, “Wow, my friend still needs to borrow money from me?!” and you might start to question their financial stability.

That’s what lenders do too.

If you are maxing out your cards or using a lot of your available credit, they might start to think that you rely too much on credit, which is a warning sign.

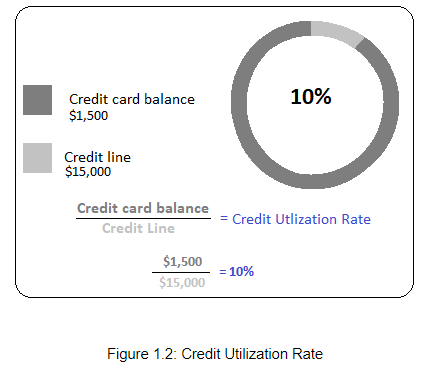

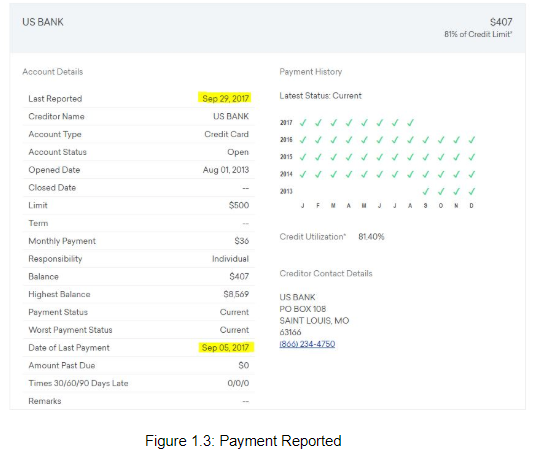

We can tell you this much If you have a high utilization, you could get your credit line decreased on other credit cards. This is the case even if you have high utilization on just a few cards. If you have a lot of credit cards but only have high balances on two or three — even though your overall credit utilization may be good, the high balances can be an indication for lenders that could result in being declined for certain things and a drop in your credit score. That’s why it’s important to always be mindful of your credit utilization.

Being smart with credit utilization can also show that you’re a prudent consumer. Let’s say you were offered a whole pie. Eating roughly one-third of it is probably a prudent move. Eating the whole thing? You’ll end up with a tummy ache.

In other words, you want to be smart with your credit utilization and keep your balances at 30 percent or less of your credit limit.

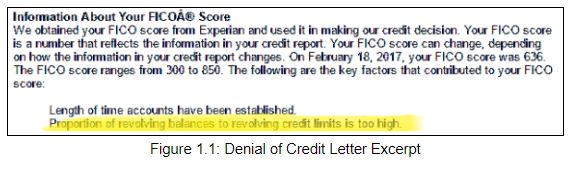

Below in Figure 1.1 you can see a portion of a real letter denying consumer credit to a consumer. While the credit score of 636 is fairly average, one of the main reasons cited for the denial is “Proportion of revolving balances to revolving credit limits is too high.” In other words, this consumer was denied credit because their credit utilization was too high.

Take Note: Credit Utilization Makes up 30% of Your Credit Score(!)

As mentioned above, your credit utilization has a major impact on your credit score. But how much does credit card utilization affect your credit score, anyway? In fact, it’s the second largest contributing factor that makes up your credit score. Your payment history makes up 35 percent of your credit score. While a bit smaller, your credit utilization still makes up a whopping 30 percent of your credit score.

So whether you’re looking to establish or rebuild your credit or simply keep your credit in good shape, your credit utilization is seriously important and can’t be ignored.

How Is Credit Utilization Calculated?

In order to stay on top of your credit utilization and stick to the less than 30 percent rule, you are probably wondering “How do you calculate credit utilization?”

You don’t need to be a math whiz to do this and with nifty calculators, it’s pretty easy.

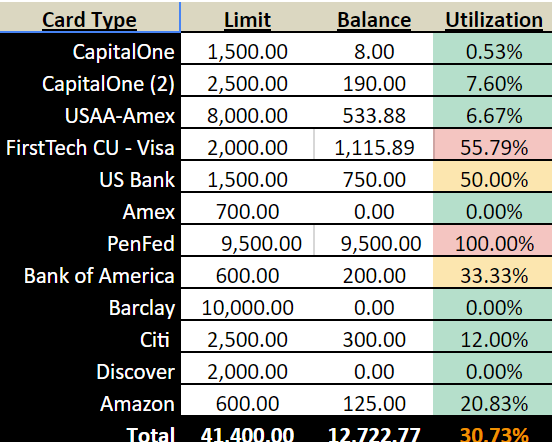

In Figure 1.2 below, you can see the calculation for credit utilization with various credit cards. You can see the credit card limit, the current balance, and how that balance equates to the utilization percentage.

To calculate credit utilization on your own is easy. Take your current balance and divide that number by your overall credit limit. Once you have that number, you can multiply it by 100 to get your credit utilization rate.

Here’s an example:

Current balance: $900

Credit limit: $2,000

When you take $900 and divide it by $2,000 you get 0.45. Multiply 0.45 by 100 and you get 45 percent. This is more than 30 percent, so you could hurt your credit score. Paying down, or paying off, the balance and keeping your utilization low in the future may help boost your credit score.

You want to keep your credit utilization at 30 percent or less on all of your credit accounts. So if you have multiple credit cards, this is something to be mindful of for all of your credit cards. You can also use an online calculator to figure out your credit utilization.

A How-To on Lowering Your Credit Card Utilization

As you can see, your credit utilization is hugely important when building credit. To keep your credit in good shape, you want to learn how to lower credit card utilization. In order to manage your credit utilization appropriately, keep your balances below 30 percent of your available credit.

So, what if you realize you’re already out of that margin?

Don’t Panic! Relax, But Take Action.

To lower your credit utilization, pay down your balances. If possible, pay your balance off in full. Essentially, your credit utilization gets reported each month by the statement date. It may help to make multiple payments throughout the month if you have high credit utilization. As you can see in Figure 1.3 below, this account with a credit utilization of 81 percent was reported a few weeks after the last payment.

Once you have lowered your balances, moving forward, keep your balances at 30 percent or less of your credit limit.

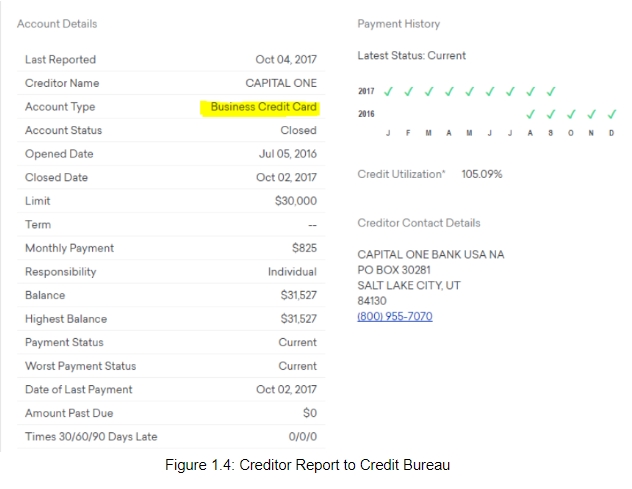

Here’s an example of what it looks like when your credit card reports a high credit utilization rate. In this case, it’s more than maxed out with a credit utilization of 105.09%! Yikes! While this can be scary, it’s important to take action and pay your card down and keep balances low.

If you’re a small business owner, in many cases, your business credit utilization won’t affect your personal credit. The exception is Capital One; but for many cards, it won’t hurt your personal score. You can see the effect of this in Figure 1.4, with a credit utilization of 105%!

You may also be able to increase your credit limit which could lower your credit utilization. However, this tactic should be taken with a lot of consideration. If you have a high balance, you may not be approved, and it could hurt your credit further. Also, if you’re already in lots of debt and have a spending issue, increasing your available credit could prove to be too tempting and lead to more debt.

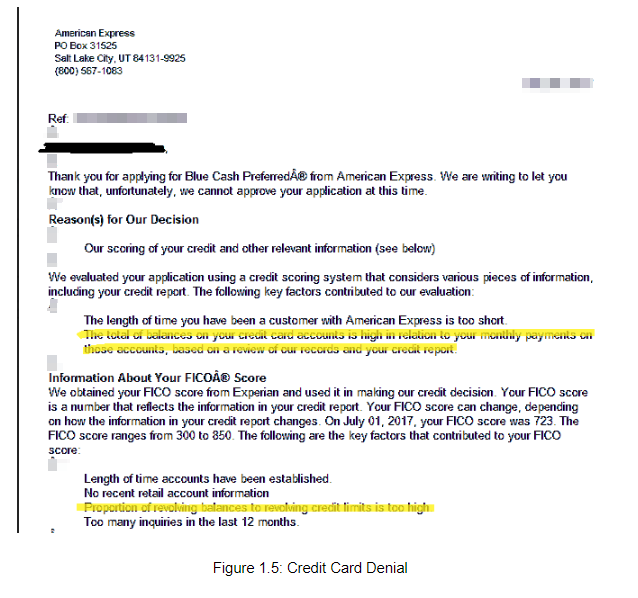

Your debt-to-credit ratio is something that is considered when you apply for a new credit card. In fact, you can get denied for a card if your debt-to-credit ratio is too high, as evidenced below.

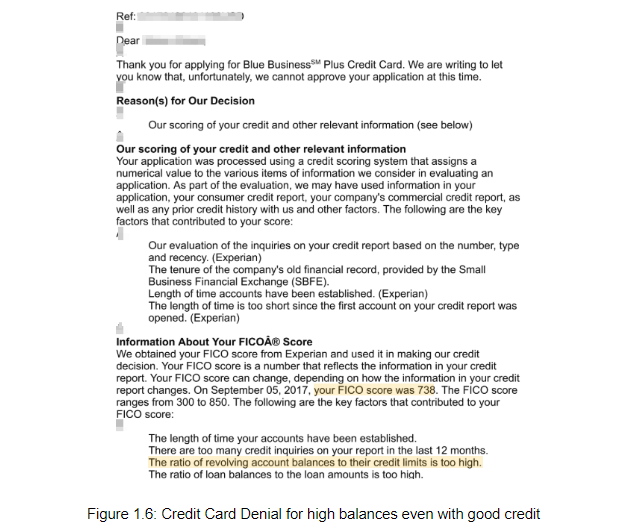

Even if you have a ‘good’ credit score, you can still be denied if you have opened too many cards and if your balances are high.

We at Scored Credit™ have seen that even if your balances are not high, if you carry balances on many cards that can be reason enough for new credit issuers to deny your application.

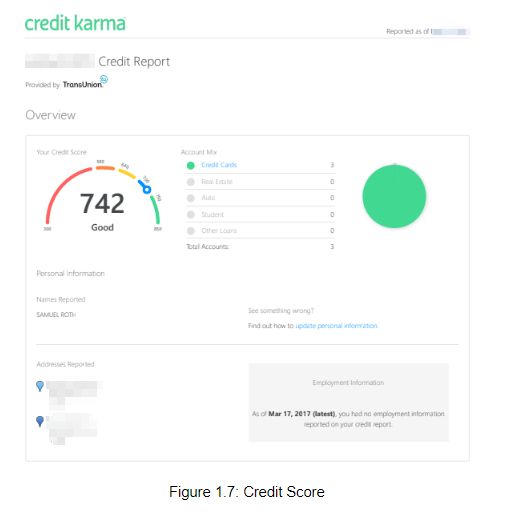

As you can see below in Figure 1.6, this consumer has a good credit score of 764 but was still denied because of too many account balances as well as having high balances. Same for another consumer with a score of 738 and who had high balances.

If you have good credit and are responsible with your card, you may be approved for an increased credit limit which would lower your overall credit utilization.

When you have a lower credit utilization overall with your credit cards, it can result in a higher score, as you can see below.

It’s Key to Know When Balances Report to Credit Bureaus

Creditors report the balance you use to the credit bureaus. If you want to keep a low credit utilization, it’s key to know when the balances report. For example, Chase will report on the statement date. If you end up paying in full a few days after, they will update your utilization.

From our experience we can tell that U.S. Bank reports anywhere between the 30th of the month and the 2nd of the next month.

If you want to hack your credit utilization, data shows that you can technically use more than 30 percent of credit limit so long as you pay off the balance before the statement date, when the balance gets reported. In other words, your balance may be able to be a little higher without affecting your credit, if you have good credit utilization by the statement date.

Where Does Debt-To-Income Ratio Fit In?

Aside from your credit utilization (which can also be called debt-to-credit), your debt-to-income ratio matters too and can affect whether you get approved for a loan. Your debt-to-income covers the ratio between your monthly debt payments and your income. So if your payments each month are eating up a lot of your income, this could look like a risk to a lender. Not only do you need to think of your debt-to-credit (aka credit utilization), you need to think of your debt-to-income ratio too.

The (Major) Impact of Credit Utilization

At the end of the day, your credit utilization has a major impact on your credit score, probably more than you realize. That’s why it’s important to monitor your spending and how much of your available credit you are using. By keeping your credit utilization low, you can keep your credit in good shape.