In this Post:

- All About the Plus Score

- What Makes a Good Plus Score?

- Differences Between Plus and Fico Scores

Your credit score is one of the main things lenders look at when deciding to approve or deny a loan.

Those three little numbers can impact quite a lot!

But when we talk about credit scores, in many cases we’re referring to the FICO score, which is the gold standard for credit score modeling. FICO is used by a lot of lenders, but did you know there are other types of credit scores?

Yes, it’s true.

One such score you may have come across is the PLUS score.

- But what is a PLUS score?

- How does it differ from FICO?

Read on to learn more.

The Plus Score: A Closer Look

A PLUS score is a type of credit score that was created by the credit bureau, Experian.

The PLUS/Experian score is between 330–830 and helps determine your relative risk and level of creditworthiness.

If your score is on the lower end of the spectrum, you may be considered a high-risk consumer with not very good credit. On the higher end, you may have good credit and be considered less of a risk to a lender.

Here’s the key thing about the PLUS score:

It is simply educational, and not used by lenders at all.

That means, you can use the PLUS score to get a general idea of where you are at with your credit, but a lender will never review this score when looking at an application for a loan.

Because of that, it’s pretty useless in the big picture. It can be a good benchmark if you want to learn where you stand.

What Is a Good Plus Score?

If you’re just starting to learn about credit, you may wonder what is a good PLUS credit score. As noted above, the higher the PLUS/Experian score the better, but obviously the range of 330-830 is pretty vast.

In general, a PLUS credit score of 780 or above means you’re in pretty good shape with your credit and in good standing. This means that you are more likely to get approved for credit, though this is not definitive as this is not the credit scoring model lenders use; so you may get denied.

Differentiating Between Plus Score and Fico Score

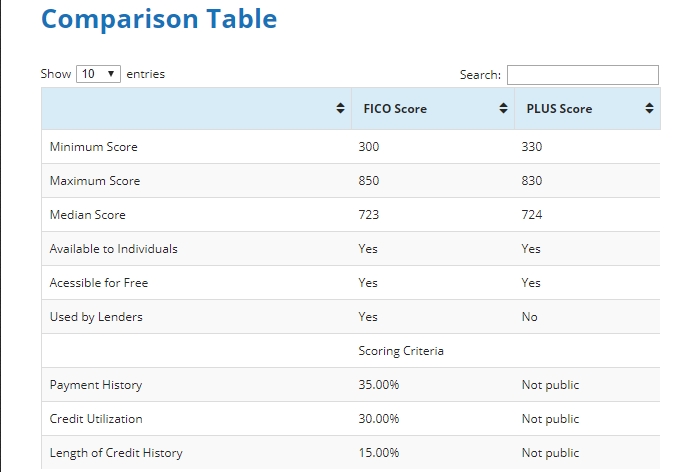

The PLUS/Experian credit score and FICO credit score are fairly similar in range.

The PLUS credit score has a range of 330–830 whereas the FICO credit score has a range of 300–850.

It’s pretty close but not the same.

So while your PLUS score may give you an indication of what your FICO score might be, there could be discrepancies. You’d have to check your FICO score to know for sure where you are at.

The most important difference is that FICO credit scores are used by many lenders in lending decisions that affect your real life:

- whether you get approved for an apartment

- what rate you will get on an auto loan

- if you get approved for a rewards credit card

All of these things are important and should be considered when you look at your credit score.

On the other hand, the PLUS credit score is never used by a lender. They won’t look at it and it doesn’t determine lending decisions. The PLUS score is basically a knock-off version of the FICO score made just for consumers. So while the PLUS score can show you the general direction of where your credit score is going, it won’t get you to the destination.

Before you apply for any credit, you’ll want to go to the source and get your FICO credit score to know what the lenders are looking at...