In this Post:

- Credit Card Grace Periods

- What’s a credit card grace period?

- Now How Exactly Does It Work?

- It’s Not All Roses and Daisies

- Maximizing Grace Periods

- Other Applications

- Go For Grace

Credit Card Grace Periods

The word grace sounds nice and comforting, like some kind of religious sentiment or a beautiful name.

What is a grace period really, when it comes to credit cards? The truth is, that the word grace not all that glam in credit cards — but it’s still comforting.

Grace periods are that stretch of time companies benevolently extend to so that we get a little breathing room to pay back money owed. However, don’t get too excited about it. The grace period is not usually months-worth of time; it’s more like in the weeks zone. But, that often gives just enough leeway to make a difference.

So, let’s dig into grace and all of her perks — and pitfalls.

What’s a credit card grace period?

This is the 21-25 day stretch of time when we can still pay off our full credit card balance without any consequences. Once we miss the mark, we’re dealing with a finance charge and interest fees on the money we have borrowed.

We can thank Congress for this stretch of time. In 2009 it established the Credit Card Act which insisted that companies deliver our statements at least 21 days before payment is due, so that we won’t get charged interest moments after swiping our cards. The grace period begins on the final day of the billing cycle and usually lasts for 21 days, during which we can pay our balance without consequence.

Caught that part? No black marks or negative impact on our credit scores… a real freebie. Payment during this period does not negatively impact credit scores, accrue interest, or result in a finance charge.

Now How Exactly Does It Work?

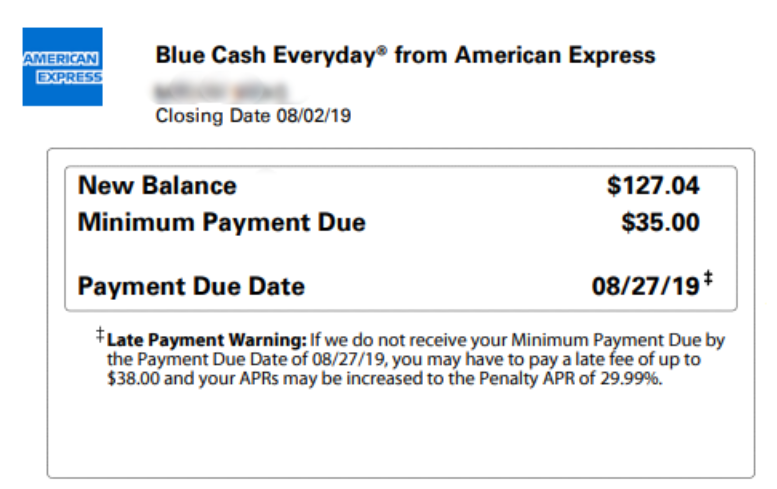

First up, know your statement’s closing date—the day of the month which marks the end of the billing cycle. (Purchases after that date go on the next month’s statement) Then, know your payment due date. The grace period is the time in between those two.

For example, if your closing date is August 15th, that means all purchases made on August 16th and onward will appear on the next month’s statement. Let’s assume your due date is September 9th; your grace period is the stretch in between. What this means is that you just got a free loan from your credit card company for a full three weeks.

“Statement closing date is when the billing cycle ends

Payment due date is usually 21 days later when the balance should be paid.”

It’s Not All Roses and Daisies

Here’s the catch.

If we don’t pay off the full balance by the due date, the grace period is gone. And now we have a new friend—she’s called interest.

Let’s say you have a balance of $2,000 that is due on September 9th (which is really from your July 15th to August 15th billing cycle). If you pay $1990 of it by the due date, that’s pretty good, but you have now forfeited your grace period. Interest is applied to your remaining $10, as well as to all of your current purchases that will appear on your August 15th to September 15th billing statement.

In short, grace periods are great, but they are only available if we pay off the full balance by that pesky due date. If we pay anything less than that, interest is immediately applied to all purchases that will appear on the next billing statement. Yes, we just officially went into credit card debt.

Here’s where things can get really wonky. Let’s say we paid that $1990 on September 9th, thinking it’s no big deal to leave a $10 balance on our accounts. The interest is barely a pinprick. Then we go ahead and swipe for a big purchase. Let’s say a $5000 couch. That unpaid balance of $10 means our new purchase is going to appear with interest on our next statement. Oops.

And yet another reminder on how important it is to have that balance of a big, beautiful, single-digit zero.

Don’t worry. We can earn back that grace period by paying off our full balance, but we just need to make sure there are no interest fees we missed. Grace will only reset if there is nothing owed.

Tip: pay a little more than your actual balance to cover any interest fees that are owed and would have appeared on your next statement. That way your balance is clear and your grace period reestablished.

And generally there is no grace period for cash advances or balance transfers, so we’d best beware of those. Interest is applied to these transactions immediately. So, for example, if we take out $1,000 and then decide to go into the bank a week later to pay it off before our statement even arrives, there will already be an interest fee on that expense.

And, not all credit cards have grace periods. Shucks.

We can find out the specifics of our credit card grace periods by looking at our credit card agreement which you most likely got when signing up for the card. It should be on the company’s website, and you can request one by mail. Credit card statements should also have some information about this under the “how your finance charges are calculated” section.

If we know we are not going to pay off our balance in full each month, then we definitely want to look out for low-interest cards.

- Grace periods are forfeit if full balance is not paid

- Interest is applied to the remaining balance of the statement you just paid, as well as subsequent purchases that will appear on next month’s statement.

- Cash advances and balance transfers generally do not have a grace period

- It is the consumer’s responsibility to understand the grace period by checking the credit card statements or original agreement

Maximizing Grace Periods

The truth is, grace periods are hidden gems. There is so much we can do with this bit of frill.

It would be great if we could call up Amex or Visa and ask them to extend our grace periods, but chances are they won’t be too amenable. But here’s an insider secret: they might be willing to change the billing cycle date, which can push off our payment. Because the company is obligated by law to give us a 21-day head’s up before payment is due, if we ask for a new due date, they may need to skip one of the billing cycles and have all of the charges appear on the next statement, effectively giving us a few extra weeks. This can be a good trick if we have a hefty bill coming up, but it’s probably best as a one-time trick rather than a go-to solution.

But in general, even without any finagling, some careful planning can transform that grace period into our personal sword that will vanquish credit card debt.

Dramatic, yes it is.

Let’s go back to our earlier example. Remember our closing date of August 15th? We’ll need to pay that balance by September 9th, but now is a great opportunity to go shopping. If we have a big expense we’ve been waiting to pay for, August 16th is the day to do it. That fee will only appear on next month’s statement, and with the grace period, we’ve got a nice stretch of time to actually pay that back, interest-free.

And now you get to brag to all your friends about your heroic exploits.

Whatever you do, just make sure you pay the full balance when its due; don’t allow yourself to wake up on September 10th only to realize you forgot to pay your bill. Because then you officially forfeited your grace period, and that August 16th expense…well it’s accruing interest as we speak. And you’ve got a late fee. And your credit score may be impacted.

So don’t brag too fast.

But if you did pay on September 10th, don’t beat yourself up too much. We’ve all been there, done that. It usually just means a late fee, and some really nice companies will even waive it for you if it’s your first late payment. Credit score consequences are only reported if your payment is 30 days late, so in that aspect you’re safe.

- Consumers can ask credit card companies to adjust billing cycle date

- Make expensive purchases at the beginning of the new cycle to get the longest stretch of interest-free credit

- Missing a payment — even by a day — means you forfeit the grace period

Other Applications

Grace periods pop up in a whole bunch of other nooks and crannies.

- Mortgages offer a short grace period which can make all the difference if we have an unforeseen delay in our expected income, or a sudden expense that gobbles up our paychecks.

- Most banks will offer a 15-day grace period past the due date, so, for example, if the payment is due on the first of the month, we usually have until the 15th of the month to pay. After that, we’re looking at late fees and possible loan default

- Car loans similarly extend a 10-day grace period, and generally only charge a late fee if the payment is between 10 and 30 days late. However, once the next payment date has arrived and the previous one is still unpaid, the lender may take action. We need to act quickly to avoid repossession.

- Utility bills are generally a bit more forgiving, and may give us a few months leeway before actually shutting off our services. But we may want to keep on top of that before we’re standing in the shower after a bout of gardening and wondering where the water is.

- And all that crushing student debt…well it’s got a grace period of up to 6 months post-graduation, and is extended for those serving in the Armed Forces for a total of three years.

- Medical bills usually have a six-month grace period after which they are sent to collection agencies who may try to negotiate a lower payment for us, however, once it gets to this point, we’re most likely looking at some negative consequences for our credit score.

Go For Grace

Knowing how our credit card billing statements and due dates work can help us take full advantage of our grace period. By organizing a thought-out spending and payment schedule, we can make our line of credit stretch pretty far.

Teaser:

Payment during the grace period does not negatively impact credit scores, accrue interest, or result in a finance charge.