In this Post:

- Lost or Stolen Credit Card?

- Reacting Quickly to a Lost or Stolen Credit Card

- The Dangers of A Lost Debit Card

- Canceling Your Lost Card Hassle-Free

- Finding a Lost Credit Card

- How Lost or Stolen Credit Cards Affect Your Credit Score

Lost or Stolen Credit Card? Learn What To Do and What NOT To Do to Avoid Costly (but Common!) Mistakes

It’s a vacationer’s nightmare. You’re on vacation and suddenly realize you lost your credit card. Or maybe it was stolen. You used it in the morning to pay for a drink and now it’s gone.

First, you panic. Then you remember that your credit card company protects you against liability for lost or stolen cards — there might even be some sort of law about it. You relax and enjoy your vacation without the hassle of canceling the lost credit card; you’ll take care of it when you come home.

But when you finally call your credit card issuer, you’re in for a rude surprise. Turns out you are liable for charges made during the time you were on vacation because you waited too long to report the lost credit card.

And that’s not the worst of it. A few months later you apply for financing for a new car and get denied because your credit score is too low.

Why would that happen?

Why would someone suddenly find that their credit score is too low to finance a new car, if they’ve always paid their bills on time and had a solid score? Could a lost card have that effect?

Reacting Quickly to a Lost or Stolen Credit Card

With millions of credit cards lost, stolen or breached each year, chances are that you’ll be affected at one time or another. But the results of having a lost or stolen card, and how much it’ll affect your credit depends on how you handle the loss.

Here are some issues credit card users should be aware of when dealing with a lost or stolen credit card:

The Identity Theft Resource Center’s (ITRC) recently published 2017 Data Breach Report stated that a whopping 14.2 million credit card numbers were exposed in 2017!

- Don’t wait; report your card lost or stolen immediately. True, there is zero-fraud liability protection, and there is a law to protect consumers. But don’t ignore the fine print.

The Fair Credit Billing Act (FCBA) protects consumers from unfair billing practices. For example, consumers are not liable for unauthorized charges on their credit cards. But there’s a catch. That only applies after you report the lost or stolen card. Before you report the card, you can be liable to pay up to $50 total for charges on the card.

We’re lucky that today most card issuers offer zero-fraud liability protection that eliminates your liability entirely if you report the lost card within a specific time limit. The industry standard is 24 hours, but you can do your homework to find out if the time limit for your issuer differs.

2. Carefully review your credit card bill. Identity thieves count on consumer laziness to get away with stealing credit card numbers and using that info to make unauthorized charges. In the case of a credit card breach, the FCBA gives you 60 days after you receive your bill to dispute unauthorized charges and avoid liability. (Your credit card company may offer you more time, but you’ll have to confirm that for each card.)

And don’t ignore questionable charges just because they’re small. Thieves often test the waters with insignificant charges before moving on to big purchases.

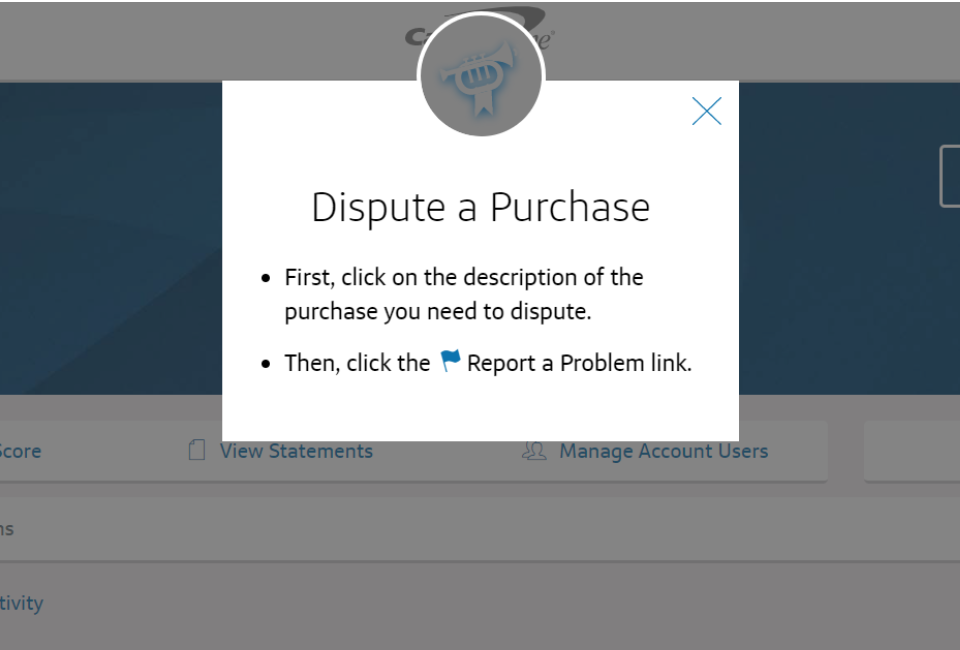

You can easily dispute fraudulent purchases from your online credit card account

The Dangers of A Lost Debit Card

As fast as you should act for a lost credit card, you should act even faster for a lost or stolen debit card. Unfortunately, liability for a debit card is much higher than for a credit card.

The federal Electronic Fund Transfer Act protects consumers in electronic funds transfers, but you can still pay some hefty fees. Under the law you are liable for:

- $0 if you report your debit card missing before any transactions take place

- $50 if you notify the bank within two business days

- Up to $500 if you notify the issuer within 60 days of receiving your bank statement

- Unlimited loss if you don’t notify your bank within 60 days of receiving your bank statement

As you can imagine, consumers were not happy about the possibility of unlimited loss or even the $500 max. As a result, some states have laws and some issuers have voluntary caps, limiting liability to $50 as they do with credit cards. Read the fine print carefully or ask your bank to know which rules apply to your card.

It’s even more crucial to contact your issuer immediately when your debit card is lost, stolen, or compromised.

Canceling Your Lost Card Hassle-Free

Cancelling a credit card used to be a time-consuming hassle. But those days are long gone. Credit card companies deal with lost or stolen credit cards all day, every day, and they’ve streamlined the process.

Typically, you have three ways to report your card lost or stolen and cancel your card:

- Phone: Call your credit card company. The phone number is printed on the back of your credit card, but of course that doesn’t help you if your card is missing. You should be able to find the number on a statement or online.

- Web: Enter your online account and report the card lost or stolen and cancel the card with a simple click.

- Mobile: Download your issuer’s mobile app (if you haven’t yet) and enter your account to report the card as lost or stolen.

Once the issuer cancels the credit card they’ll do two things:

- Block your card instantaneously. Within seconds, your card is flagged electronically, and all future transactions blocked.

- Issue a new card. Most companies will offer free, expedited shipping for replacement cards — perhaps even overnight if you ask for this service.

Today, it’s quick and easy to cancel your lost or stolen card and receive a new one.

If you’re certain that the card was stolen, you have to file a police report. This report is to protect you and serve as evidence if you have to dispute further charges. If you’re not sure if your card was lost or stolen, experts say you can skip the police report.

What if the lost or stolen card is already expired? Is it still necessary to report and cancel it?

Experts say, “yes.” As long as your current card has the same number as your expired one, a thief can easily guess your new expiration date and charge your account.

Finding a Lost Credit Card

Sometimes, your credit card is AWOL, but still likely to turn up. Most often, this happens when you last saw your credit card at home.

What should you do? Is it worth canceling the card only to find out that it wasn’t lost? On the other hand, waiting can leave you liable for fraudulent charges as we mentioned above, or harm your credit score as we’ll discuss later.

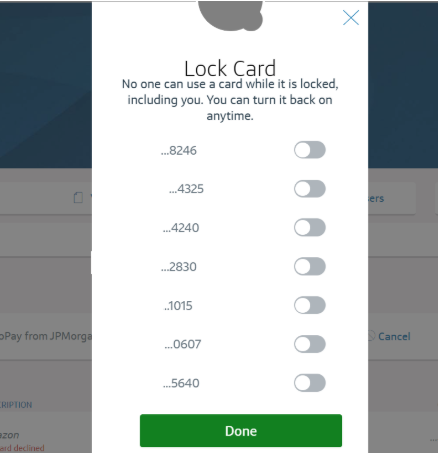

Many companies now offer a nifty option custom made for this situation. With a single click in your online account, you can temporarily “freeze” or “lock” your account. This option is available for nearly all debit cards and, increasingly, for credit cards such as Chase, Capital One, Amex or Discover.

Locking card online

When your account is locked, the bank will block new purchases, cash advances, and balance transfers. Other transaction like recurring payments will still go through.

While your card is locked or frozen, you can search like crazy for your missing card. Think about where you last saw it. Retrace your steps.

Check:

- Coat and pants pockets

- Purses

- Between and under the seats of your car

If you find the card, you can easily unfreeze your card online. But if the card is still missing after 48 hours, it’s time to report the lost card and order a new one.

New “freezing” or “locking” features give you time to find your lost credit card.

How Lost or Stolen Credit Cards Affect Your Credit Score

So, what about your credit score?

On the simplest level, a lost or stolen credit card should not affect your credit score.

But while the new card doesn’t directly impact your credit score, it can indirectly harm it in three ways:

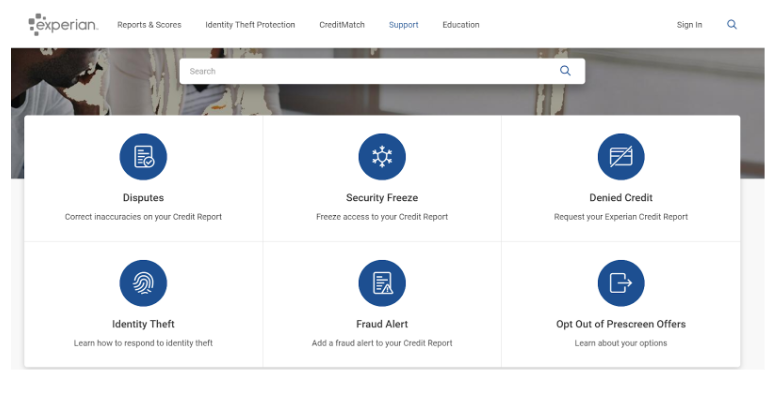

- If your credit card was compromised in a data breach, the criminal might have access to other personal information like your social security number, address, or birthday. In that case, the crook can easily damage your credit score while acting in your name. It’s crucial that you alert the credit bureaus and closely monitor your credit reports for a few months after the incident. If necessary, you can get a credit freeze until the issue is resolved.

Placing a fraud alert online

- You can also be affected if you have a lot of recurring payments set up on your card. After you cancel the card, those payments won’t go through. They get marked as late payments, incur fees, and damage your credit score.

You can prevent this by going to all your accounts with recurring payments and putting in your new credit card information. Consumers should have a running list of all those accounts to make this process as painless as possible.

If you don’t have a list, you can check your credit report for a list and monitor your credit card statement online for a few months to catch all those charges. Monitoring your statement is recommended anyway, to find any fraudulent charges that didn’t show up right away.

Monitor your credit card statements and credit report for a few months after your credit card is lost, stolen or breached.

- If you lose credit cards on multiple, frequent occasions, it can call your sense of responsibility into question, and that can affect your credit score, too.

In general, responsibility is the key here. Your lost credit card story can easily have a happy ending if you:

- go through your credit card statements monthly

- report losses right away

- keep an eye on your credit score