In this Post:

- Your Credit Card Limit was Reduced

Ever walk into a store, ready to make a big purchase with your credit card, to find that you can’t because the credit limit has been slashed? This has happened to me twice.

It may mean that your credit card limit was reduced. That’s a pretty nasty surprise.

This is also why it’s wise to have a back-up card or enough cash in a checking account to pay for what you want — but that’s another story.

Data theft is one very large reason for the lowering of credit limits. If you paid attention to recent news reports, you know that large scale data thefts are giving merchants and creditors major headaches. Thieves have managed to steal the personal and financial data of many millions of cardholders, causing widespread identity theft problems. Because consumers are protected against fraudulent charges, credit card issuers typically absorb the cost of the crime. To minimize damage, some credit card issuers reduce the credit lines of those who used their cards at the compromised retailers.

Not being able to charge what you want is an inconvenience, but if you carry balances over from month to month, your credit rating can be hurt. This holds even more true when your credit limit is reduced.

Credit utilization is the second most important factor in credit score calculations (the first is the way payment history). Owing less than 30 percent of what you can charge is ideal. But say your credit card has a $10,000 limit, and you owe $1,000. You would only be utilizing 10 percent of the line, putting you in great scoring shape.

However, if your utilization ratio limps to the side of large debt and low score, your credit line can be decreased.

Now, if you do spend up to (or very close to) the limit and want to prevent a limit reduction, find out the closing date for your account, and pay the balance before that date. You don’t want your utilization ratio to be determined while you’re still carrying an overly large debt. This way your card’s charging limit should remain intact.

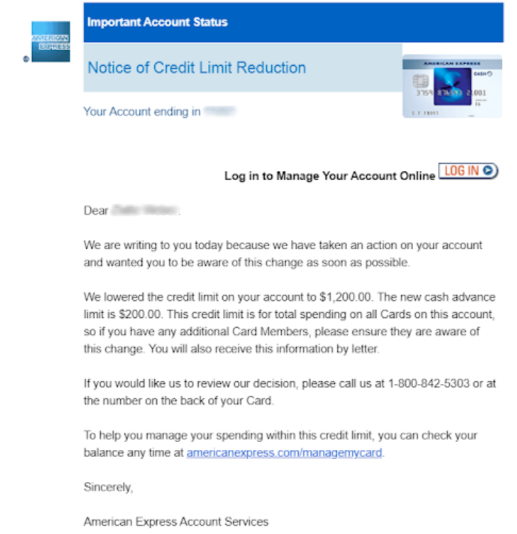

A notice from American Express noting that the credit limit was reduced

Your Credit Card Limit was Reduced

Other reasons you might have your credit card limit reduced may be due to your own credit activity.

For example:

- You haven’t used the card in a long time.

- You recently applied for or opened several new accounts.

- You have more debt than you did in the past.

In most cases it’s a temporary credit limit reduction (unless you’ve done something wrong) but if you happen to be in the process of applying for a mortgage or other big ticket financing arrangement, it could really mess things up for a bit.

If you’re ever wondering why your credit line was reduced, call your bank and ask. This way you know what is going on with your credit and how you can make things better for the future.